Has a client ever unexpectedly deducted money from your payments? There might have been a set-off clause in your contract.

So what IS a set-off clause? What can you do to reduce the risks it might cause for your business?

What Is A Set-Off Clause?

A set-off clause is a provision that allows the end client to deduct money from payments that it owes to the service provider. The purpose of the deduction is to:

- recover a debt owed by the service provider to the client; or

- compensate the client for some claim or loss that it says it has suffered.

Clients may have some narrow set-off or counterclaim rights at law, no matter what the set-off clause says. However, set-off clauses tend to give the client a lot of extra rights they would not otherwise have.

I’m A Service Provider – Why Should I Be Worried About A Set-Off Clause?

Imagine that you’ve been working on a flagship project. You’ve just finished a big chunk of the scope and the client seems pretty happy with it.

You’re counting on the payment for that work to keep your business afloat, because you’ve worn all the costs involved in delivery. You’ve already paid for the materials, your employees and your subcontractors.

The end of the month rolls around and you submit a nice fat invoice. You budget your short to medium term expenses on the assumption that your invoice will be paid in full. Happy days!

Then – shock horror – the customer only pays a small portion of the anticipated payment. They say they have deducted or back-charged the rest to offset the potential cost of rectifying some damage you did to their property or replacing a perceived defect in your work. And they haven’t even incurred the cost yet! How can this be possible?

It is possible, if you’ve agreed to a wide, unilateral right of set-off in the contract.

Where Would I Find A Set-Off Clause?

Usually, it will be somewhere close to the payment clause. But it might not be called a “set-off”. Look out for set-offs disguised as “deductions”, “customer entitlements” or “back charges”.

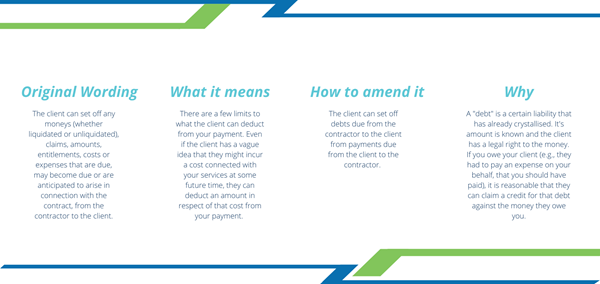

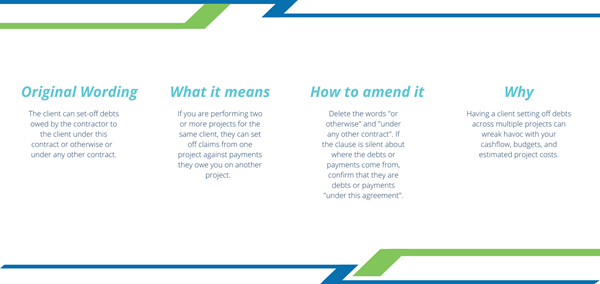

What Are The Top 2 Risks I Should Look Out For In A Set-Off Clause?

If you’re the service provider, you want to limit the customer’s right of set-off so that it is as narrow as possible. Here are the 2 major things you should think about:

But Will My Client Kick Up A Stink?

No, they won’t. It is entirely reasonable to ask your client to limit the right of set-off to actual debts owed within the particular project that the contract deals with.

Some clients may ask to retain some rights to claim back charges that are not yet debts. If you’ve invited the discussion, you can then consider that request in the context of your project and the specific risks. However, your first position should always be to limit to debts due under the contract at hand.

I’m Not Sure About This Big, Long Clause In My Contract, That Looks Like It Might Be A Nasty Set-Off – Where Can I Get Help?

SoundLegal is here to help. Get in touch and ask us to talk you through the changes you should ask for.

This post was originally published on Business Foundations.